Fair value hierarchy

Fair value hierarchy

Fair value is a market-based measure, not an entity-specific one.

Therefore, valuation techniques used to measure fair value maximise the use of relevant observable inputs and minimise the use of unobservable inputs.

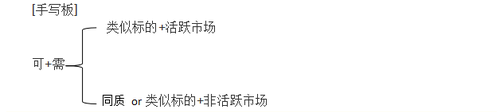

To increase consistency and compatibility in fair value measurements and related disclosures, IFRS 13 establishes a fair value hierarchy that categorises the inputs to valuation techniques into 3 levels:

Level 1 inputs: Quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date.

Level 2 inputs: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. prices) or indirectly (i.e. derived from prices), e.g. quoted prices for similar assets in active markets or for identical or similar assets in non-active markets or use of quoted interest rates for valuation purposes.

Level 3 inputs: Unobservable inputs for the asset or liability, e.g. discounting estimates of future cash flows. Level 3 inputs are only used where relevant observable inputs are not available or where the entity determines that transaction price or quoted price does not represent fair value

相关试听 更多>