Schemes to Restruction

老师您好,

请问为什么这里不是Property+Plant+Vehicles的价格一起减去清算成本和一级债呢?

谢谢老师

问题来源:

Nomore Ltd, a private company that has for many years been making mechanical tools, is faced with rapidly falling sales. Its bank overdraft (with MA Bank) is at its limit of $1,200,000. The company has just lost another two major customers.

|

STATEMENT OF FINANCIAL POSITION (EXTRACT) |

|

|

|

31. 3. X2 Projected |

|

Non-current assets |

$’000 |

|

Freehold property |

5,660 |

|

Plant and machinery |

3,100 |

|

Motor vehicles |

320 |

|

Current assets |

1,160 |

|

Total assets |

10,240 |

|

Ordinary shares of $ 1 |

5,600 |

|

Accumulated reserves/(deficit) |

(6,060) |

|

Total equity |

(460) |

|

STATEMENT OF FINANCIAL POSITION (EXTRACT) |

|

|

|

31. 3. X2 Projected |

|

Non-current liabilities |

$’000 |

|

10% loan 20X8 (secured on freehold property) |

1,600 |

|

Other loans (VC bank, floating charges) |

4,800 |

|

|

6,400 |

|

Current liabilities |

|

|

Trade payables |

3,100 |

|

Bank overdraft (MA bank, unsecured) |

1,200 |

|

Total equity and liabilities |

10,240 |

Other information:

• The freehold property has a market value of about $5,750,000.

• lt is estimated that the break-up value of the plant at 31 March 20X2 will be $2,000,000.

• The motor vehicles owned at 31 March 20X2 could be sold for $200,000.

• In insolvency, the current assets at 31 March 20X2 would realise $1,000,000.

• Insolvency proceeding costs would be approximately $500,000, this will rank first for repayment.

The company believes that it has good prospects due to the launch next year of its new Pink Lady range of tools and has designed the following scheme of reconstruction:

• The existing ordinary shares to be cancelled and ordinary shareholders to be issued with $2,000,000 new $1 ordinary shares for $1.00 cash.

• The secured loan to be cancelled and replaced by a $1,250,000 10% secured bond with six-year term and $600,000 of new $1 ordinary shares.

• VC Bank to receive $3,200,000 13% loan secured by a fixed charge and 1,100,000 $1 new ordinary shares.

• MA bank to be repaid the existing overdraft and to keep the overdraft limit at $1,200,000 secured by a floating charge.

If this plan is implemented, the company estimates that its profits before interest and tax will rise to $1.441 million and its share price will rise to $1.50.

Required

Evaluate whether the suggested scheme of reconstruction is likely to succeed.

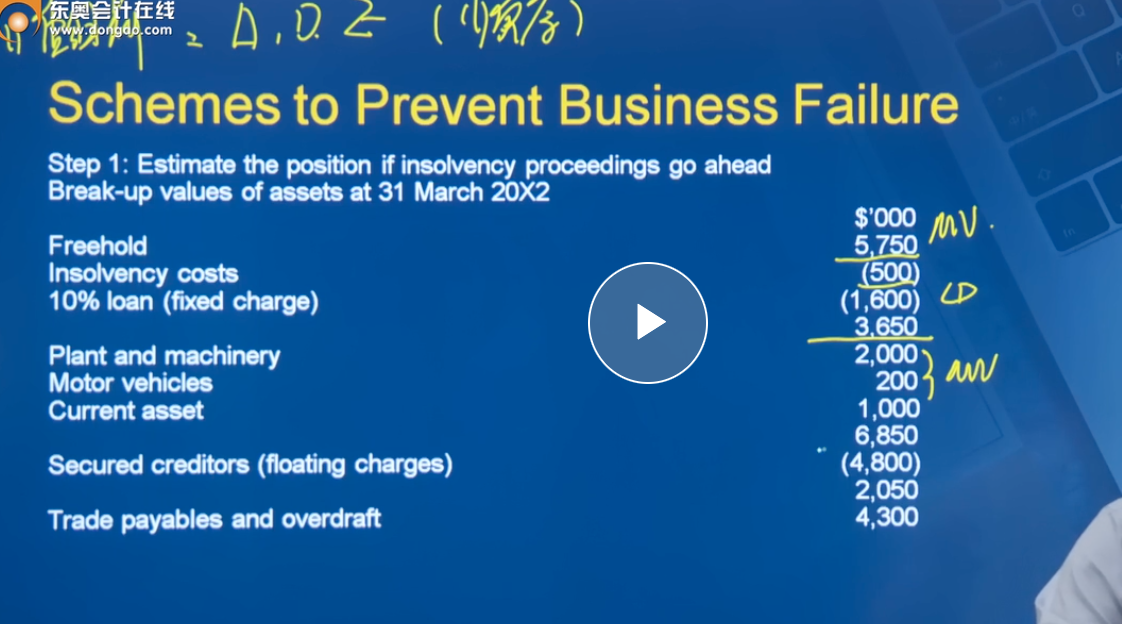

Step 1: Estimate the position if insolvency proceedings go ahead

Break-up values of assets at 31 March 20X2

|

|

$’000 |

|

Freehold |

5,750 |

|

Insolvency costs |

(500) |

|

10% loan (fixed charge) |

(1,600) |

|

|

3,650 |

|

Plant and machinery |

2,000 |

|

Motor vehicles |

200 |

|

Current asset |

1,000 |

|

|

6,850 |

|

Secured creditors (floating charges) |

(4,800) |

|

|

2,050 |

|

Trade payables and overdraft |

4,300 |

If the company was forced into insolvency, the secured loan and other loans would be met in full but, after allowing for the expenses of insolvency proceedings, the bank and trade creditors would receive a dividend of 48c per $. The ordinary shareholders would receive nothing.

Step 2: Apply the reconstruction and evaluate the impact on affected parties

Secured loan

Under the scheme they will receive securities with a total nominal value of $2,150,000 ($1.25m bond+$0.9m shares being 600,000 shares at$1.5); this is a significant increase. The new bonds issued can be secured on the freehold property. So, this may well be acceptable but it depends on whether they agree with the share valuation and whether the increase in wealth compensates for the greater risk less security).

VC

VC's existing loan of $4.8m will, under the proposed scheme, be changed into a $3.2m secured loan and $1.65m of ordinary shares (1.1m shares at $1.50). In total this gives total loans of $4,450,000 (including the bond) secured on property with a net disposal value of $5,750,000 (so the security given by the property comfortably covers the full value of the debt that is secured on the property).The scheme will give an improvement in security for VC on the first $3,200,000 to compensate for the risk involved in holding ordinary shares. This is a marginal gain for a position that exposes the bank to high levels of risk.

MA bank

This should be acceptable because of the security of a floating charge.

Ordinary shareholders

In insolvency proceedings, the ordinary shareholders would also receive nothing. Under the scheme, they will lose a degree of control of the company because 3.7m shares will be in issue (2m for existing shareholders + 0.6m for secured loan holder + 1.1m for VC bank) and they will only own 2m of these, ie 54% of the total. However, in exchange for their additional investment, equity in a company which will have sufficient funds to finance the expected future capital requirements and which will offer a capital gain compared to their initial investment of $1.

Step 3: Check if the company is now financially viable Cash flow forecast, on reconstruction

|

|

$’000 |

|

Cash for new shares from equity shareholders |

2,000 |

|

Repayment of overdraft |

1,200 |

|

Cash available |

800 |

A cash flow forecast will be required to establish whether this is a sufficient cash base for the company post-reconstruction.

Conclusion

This scheme of reconstruction might not be acceptable to all parties, if the future profits of the company seem unattractive. In particular, VC might be reluctant to agree to the scheme. In such an event, an alternative scheme of reconstruction must be designed, perhaps involving another provider of funds (such as another venture capitalist). Otherwise, the company will be forced into insolvency.

迟老师

2021-11-03 13:27:47 611人浏览

这里涉及到一个偿还顺序问题,有抵押物先扣抵押物的资产,然后如果不够再从流动资产里面扣除。不可以把抵押物和流动资产加到一起,共同进行清算,考试的时候也要按老师讲的顺序进行计算以免出现错误

每个努力学习的小天使都会有收获的,加油!相关答疑

您可能感兴趣的ACCA试题

- 单选题 某投资者一年前以每股40美元的价格购得股票,每年的股息为1.50美元。目前该股的价格为45美元,持有该股票一年的收益率是多少( )。

- 单选题 投资者已经收集了以下四种股票的信息: 股票 β 平均收益(%) 回报的标准差(%) W 1.0 9.5 13.2 X 1.2 14.0 20.0 Y 0.9 8.4 14.5 Z 0.8 6.0 12.0 风险最低的股票是( )。

- 单选题 公司卖出了一个看跌期权,行权价格为$56,同时购买了一个行权价格为$44的看涨期权;购买期权时股票的价格为$44;看涨期权费为$5,看跌期权费为$4,目前的价格上涨了$7,那么ABC公司因为看涨期权取得或是损失的金额为多少( )。

津公网安备12010202000755号

津公网安备12010202000755号