Option Hedge中对比的百分比是多少?

老师您好,

请问这道题里的合约future rate应该是5.45%啊,为什么算basis的时候用的是5.35%与spot rate 5.25%的差呢?

第一张图片里说了这个公司进入了put option to sell at 5.45%

问题来源:

Interest Rate Options

Introduction to Exchange-traded Interest Rate Option

Steps in an Exchange-traded Options Hedge

Evaluation of Exchange-traded Options Hedge

Introduction to Exchange-traded Interest Rate Option

Exchange-traded interest rate option: an agreement with an exchange to pay or receive interest at a pre-determined rate on a standard notional amount over a fixed standard period(usually three months) in the future.

• Put option: an option to pay interest at a pre-determined rate on a standard notional amount over a fixed period in the future.

• Call option: an option to receive interest at a pre-determined rate on a standard notional amount over a fixed period in the future.

Steps in an Exchange-traded Options Hedge

The steps are almost identical to the futures hedge, the differences are highlighted below.

|

Step 1: Now |

Contracts should be set in terms of call or put options - choosing the closest standardised option date after the loan begins, and adjusting for the term of the loan compared to the three-month standard term of an interest rate future. Pay a premium for the option. |

|

Step 2: In the future |

Complete the actual transaction on the spot market. |

|

Step 3: At the same time as step 2 |

Close out the options contract on the futures market by doing the opposite of what you did in Step 1 but only if the option makes a profit Calculate net outcome. |

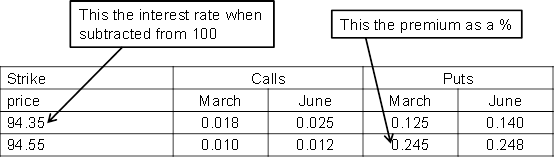

Altrak is considering using the options market. It is 1 December, and the exchange is quoting the following prices for a standard $500,000 three-month contract. Contracts expire at the end of the relevant month. LIBOR is 5.25%.

Required

Illustrate an option hedge at 5.45% (the rate closest to the current spot rate implying a strike price of 100 - 5.45 = 94.55), assuming a loan is taken out at LIBOR + 1% and LIBOR on 1 March is 5.75%.

Note. It is quicker to leave your answer in %, and to convert into $s as a final step.

Step 1: On 1 December

Put options are required as Altrak is borrowing.

Number of contracts:

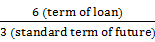

=$5m loan / $0.5m contract size× =20 contracts

=20 contracts

Date: as for futures, cover is required until the loan begins.

Altrak should enter into 20 March put options (to sell) at 5.45%

A premium of 0.245% is paid.

Step 2: 1 March

Complete the actual loan: Altrak will borrow at LIBOR + 1% so this is 5.75+1=6.75%

Step 3: 1 March

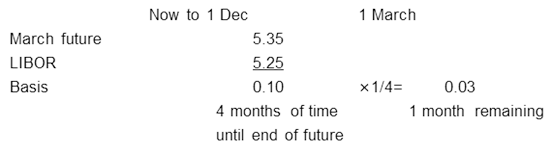

Forecasting the futures price on 1 March (as for interest rate futures)

The March future rate is forecast to be 0.03% above LIBOR on 1 March, so if LIBOR is 5.75% the future price should be 5.75 + 0.03 = 5.78%

Close out the options by doing the opposite of what you did in Step 1 (if a profit is made).

|

1 Dec put options to pay interest at |

5.45% |

|

1 March contract to buy receive interest at |

5.78% |

|

Difference |

0.33% |

Opting to pay interest at 5.45% and receive interest at 5.78% gives a profit of 0.33%. This is paid to Altrak by the exchange as compensation for interest rates rising.

Calculate net outcome

As a percentage this is 0.245% (Step 1) + 6.75% (Step 2) minus 0.33% (Step 3) = 6.665%

In $s this is 0.0665 × $5 million × 6 months (term of loan) / 12 months (interest rates are in annual terms) = $166,250.

Evaluation of Exchange-traded Options Hedge

|

Advantages of options |

Disadvantages of options |

|

·Flexible dates (like a future) |

·Only available in large contract sizes |

|

·Allow a company to take advantage of favourable movements in interest rates. |

·Can be expensive due to the requirement to pay an up-front premium. |

|

·Useful for uncertain transactions, can be sold if not needed |

|

迟老师

2021-11-03 07:36:24 578人浏览

你说的是对的 这里应该是5.45%与5.25%去对比 这个后期我们会进行勘误

每个努力学习的小天使都会有收获的,加油!相关答疑

-

2023-03-02

-

2023-02-27

-

2021-11-03

津公网安备12010202000755号

津公网安备12010202000755号