swap里的交换是什么意思?

请问最后的swap方案里Alt公司以6.25%去借$,A公司以5%去借欧元,然后Alt把6.25%的利率给A,那为什么会收回来一个4.25%的?没明白4.25%这个数是怎么来的

问题来源:

Currency Swap

Currency swaps are similar to interest rate swaps but normally involve the actual transfer of the funds that have been borrowed (the initial capital is swapped at the start and then back at the end to repay the original loans).

Altrak Co intends to purchase a European company for €90 million with euro debt finance. Franco is a European company that is setting up operations in the US and wants to use $ debt finance. A bank has indicated that it can organise a swap for a fee of 0.2% to each party.

The principal amount will be exchanged and re-exchanged at the start and end of the swap. The exchange of principal will be at the rate of €0.90 to the $.

|

Variable rates |

Altrak |

Franco |

|

$% |

6.25% |

7.25% |

|

€% |

4.50% |

5.00% |

Required

Estimate the gain or loss in % to both Altrak and Franco from entering into this swap.

Step 1 - assess potential for gain from swap

|

|

Altrak |

Franco |

Difference |

|

$% |

6.25% |

7.25% |

1.00% |

|

€% |

4.50% |

5.00% |

Altrak 1% cheaper 0.50% |

Difference of differences=1.00%-0.50%=0.50%

If a swap uses Altrak's comparative advantage in $ finance, as is suggested here, then a gain of 0.50% (before fees) is available. This falls to 0.5 - (2 × 0.20%) = 0.1% after fees. If this is split evenly it gives a gain of 0.05% to each partly.

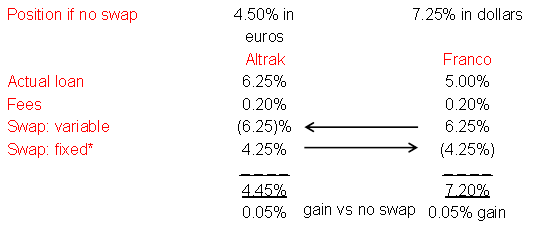

Step 2- swap, variable rate at LIBOR, designed to splitting gain 50 : 50, ie 0.05% each

王老师

2021-05-09 05:44:56 1039人浏览

哈喽!努力学习的小天使:

Alt的目的是借欧元,在利率优势中Alt公司通过swap方案降低借欧元的利率

首先:在能够节省0.05% 所以借欧元的利率为4.5%-0.05%=4.45%,最终的利率确认了4.45%,

其次:在swap variable 和 fixed 是Alt公司设计的互换方案,如果将swap variable 确定为6.25%后,swap fixed 就会倒挤出来。倒挤数就是4.25%。

每个努力学习的小天使都会有收获的,加油!

相关答疑

-

2024-10-27

-

2023-03-02

-

2023-02-27

-

2023-02-20

-

2021-11-03

津公网安备12010202000755号

津公网安备12010202000755号