问题来源:

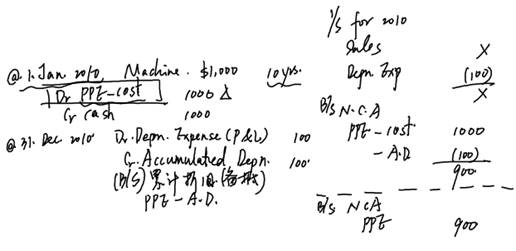

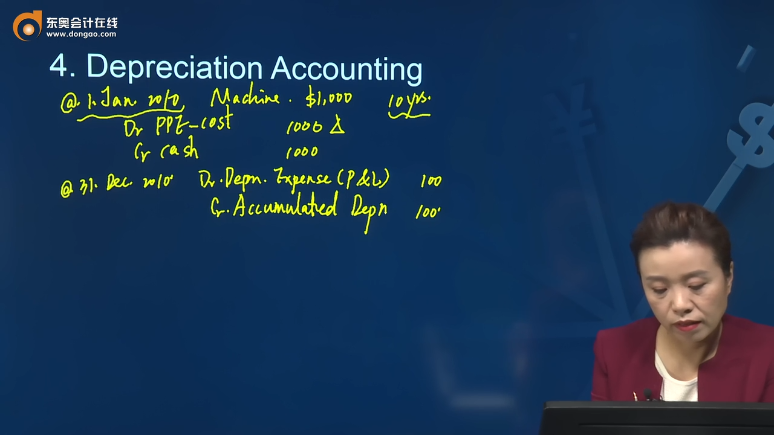

4. Depreciation Accounting

Depreciation is the charge to the statement of profit or loss toreflect the consumptionof an asset in a period. By applying depreciation charges, we are consistent with the ACCRUALS / MATCHING CONCEPT i.e. applying the cost of using the asset to the statement of comprehensive income for the same period.

All tangible non-current assets should be depreciated on a systematic basis per I.A.S. 16, with the exception ofland.

This is because land is seen to appreciate in value.

Intangible non-current assets are amortized over their useful economic life (this is just another term for depreciation).

4.1 Depreciation has dual effects:

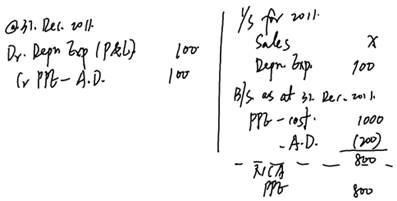

(a) depreciation is charged as an expense in the P&L account

(b) The corresponding credit is accumulated in the provision for depreciation account in the balance sheet to offset against the original cost of the fixed assets.

DrDepreciation expensexx

CrAccumulated Depreciationxx

1.5 Residual value of an asset is the estimated amount that an entity would currently obtain from disposal of the asset, after deducting the estimated costs of disposal, if the asset were already of the age and in the condition expected at the end of its useful life.(IAS16)

1.6 Carrying amount (Net book value) is the amount at which an asset is recognized after deduction any accumulated depreciation and accumulated impairment losses.

The balance of accumulated depreciation on the SOFP is the total accumulated depreciation. This is always a credit balance brought forward in the ledger account for depreciation. The non-current asset accounts are unaffected by depreciation. In the SOFP of a business, the total balance on the "Accumulated Depreciation" account is set against the value of non-current asset account to derive the NBV of the non-current asset.

4.2 Depreciation methods

The depreciation method used shall reflect the pattern in which the asset's future economic benefits are expected to be consumed by the entity.

4.2.1 Straight line method直线折旧法

Depreciation per annual=Original cost – estimated residual value

Estimated useful Life

4.2.2 Reducing balance method余额递减法/加速折旧

This method of depreciation is generally used for assets which tend to lose more value in the initial years and require greater maintenance in the later years. A good example would be a brand new motor vehicle.Motor vehicles tend to depreciate rapidly in the earlier years and require very little maintenance.

Depreciation per annual = Depreciation rate% × opening NBV

Example:A machine was bought on 1 Jan. 2010 for $5,000, with useful life 6 years. It is depreciated on reducing balance method with reducing rate 20%.

YearOpening NBV×20%Depn. Exp.A.D.NBV

15000*20%1,0001,0004,000

24,000*20%8001,8003,200

33,200*20%6402,4402,560

于老师

2021-10-07 19:41:35522人浏览

备抵科目(Contra account)是资产的备抵科目,贷记表增加,余额在贷方,用来抵减资产在B/S上的列示金额。

PPE原值与累计折旧在资产负债表上分别列示,原值即原值不能够冲减,有备抵科目的资产,都是以历史成本属性计量。PPE-cost科目余额是资产的历史成本(原值),不能随意变动。所以用备抵科目记录减值,摊销,折旧等等,如坏账疑账计提坏账准备的'Allowance',无形资产的累计摊销皆使用备抵科目。

希望可以帮助到您O(∩_∩)O~相关答疑

-

2022-03-21

-

2022-03-21

-

2022-03-21

津公网安备12010202000755号

津公网安备12010202000755号