问题来源:

Exercise

|

The trial balance of Petty as at 31 December 2020 was as follows: |

||

|

Dr. |

Cr. |

|

|

Sales |

55,000 |

|

|

Purchase |

15,700 |

|

|

Distribution cost |

8,000 |

|

|

Administration expenses |

14,850 |

|

|

Inventory |

6,000 |

|

|

Cash |

9,950 |

|

|

Trade and other receivable |

10,000 |

|

|

Allowance for receivable |

1,200 |

|

|

Land and building - Cost |

22,000 |

|

|

- Accumulated depn. |

10,000 |

|

|

Plant & Equipment - Cost |

55,000 |

|

|

- Accumulated depn. |

25,000 |

|

|

Trade and other payable |

20,000 |

|

|

10% Loan note |

8,000 |

|

|

Ordinary shares 50c |

8,000 |

|

|

10% Preference shares $1 |

9,000 |

|

|

Share premium |

3,000 |

|

|

Accumulated profit at 1 Jan. 2020 |

1,800 |

|

|

Loan note interest paid |

500 |

|

|

Preference dividend paid |

900 |

|

|

Interim ordinary dividend paid |

1,600 |

|

|

Current tax |

500 |

|

|

Suspense |

3,000 |

|

|

Total |

144,500 |

144,500 |

The following is to be taken into account:

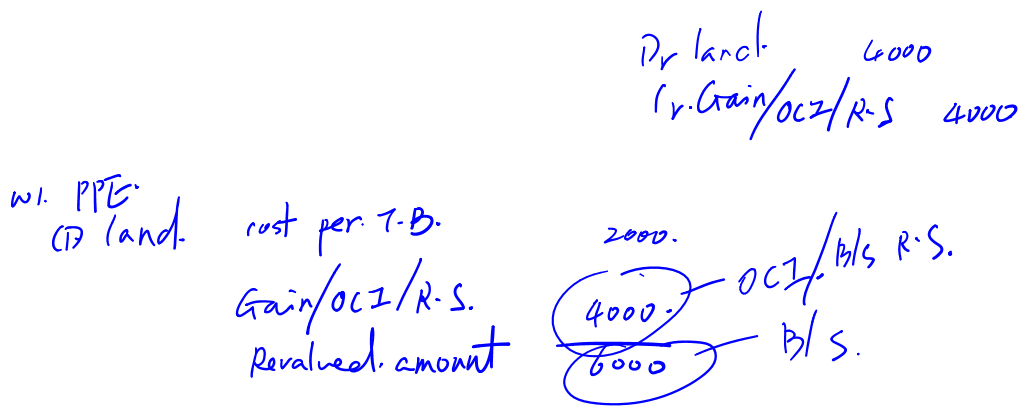

(1) A non-depreciable land included in the trial balance at $2,000 was revalued to $6,000 at the year end and this revaluation is to be included in the financial statements.

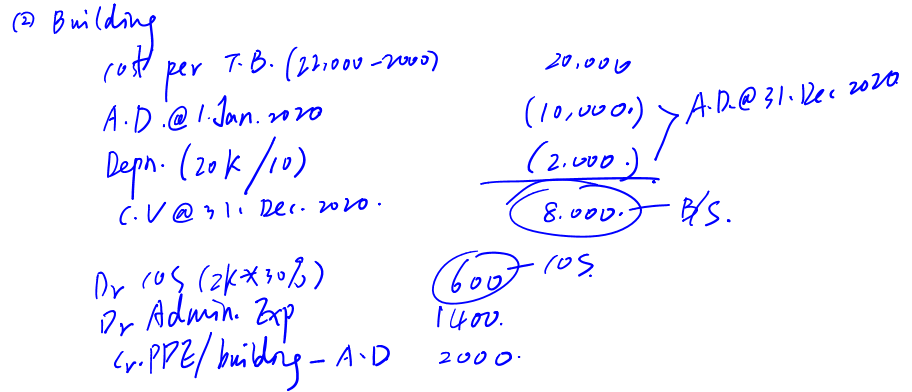

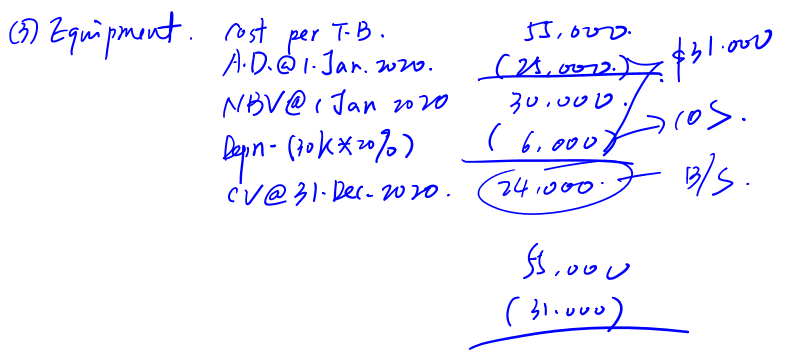

As for other fixed assets, the depreciation is to be provided for as follows:

|

Building |

10% per annual |

straight line method |

|

Equipments |

20% per annual |

reducing balance method |

Depreciation of building is apportioned as follows:

|

% |

|

|

Cost of sales |

30 |

|

Admin. expenses |

70 |

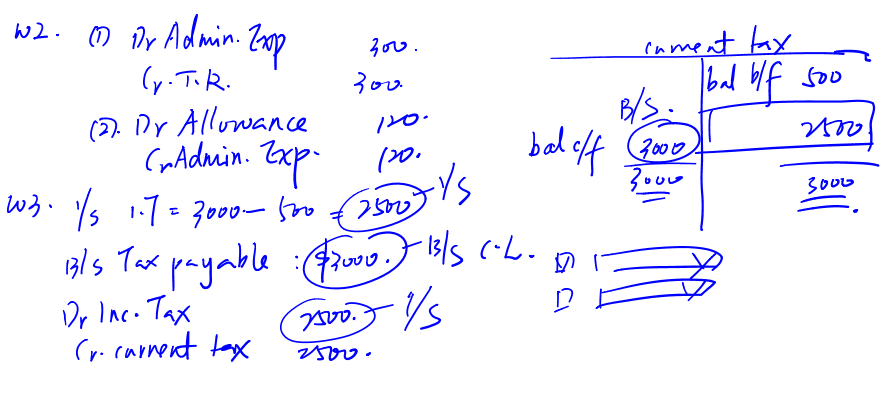

(2) It has been determined that trade receivables of $300 are irrecoverable. In addition, it was decided that the allowance for receivable should be decreased by $120.

(3) The balance on the income tax account represents an over-provision of tax for the previous year. Tax for the current year is estimated at $3,000.

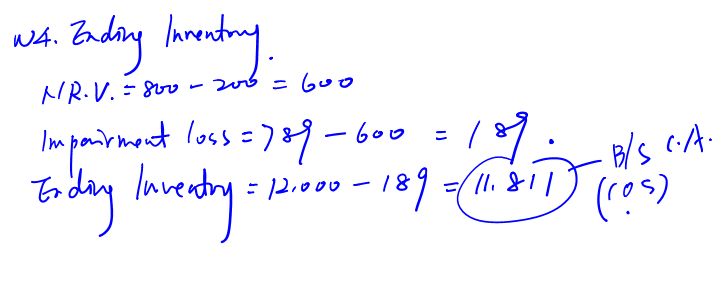

(4) Closing inventory is $12,000. Included in this balance was a set of inventory costing $789 that, due to a damage in fire, is now subject to further repair. It is estimated that after a repair costing $200, it can be sold for $800.

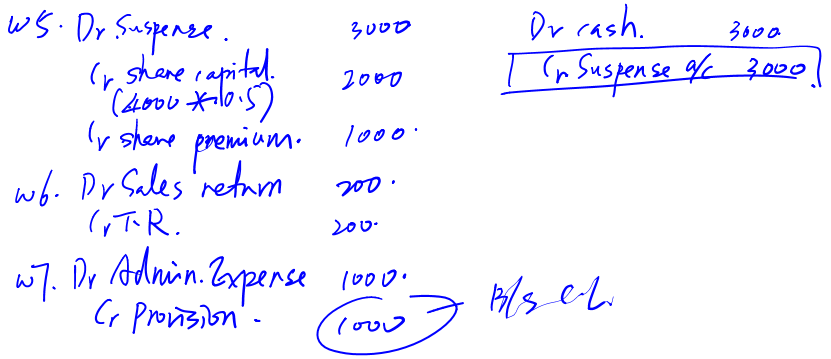

(5) The balance on the suspense account represents the proceeds from the issue of 4,000 ordinary shares.

(6) A customer bought a good on credit from Petty for $200 on 10 Dec. 2020. They returned this good on 29 Dec. 2020. No entries have been posted for this return.

(7) Petty is being sued by a customer for faulty goods. Legal advisers think it is probable the Petty will lose the case and pay damages of $1,000 in 2021. Legal costs are charged to administration expenses.

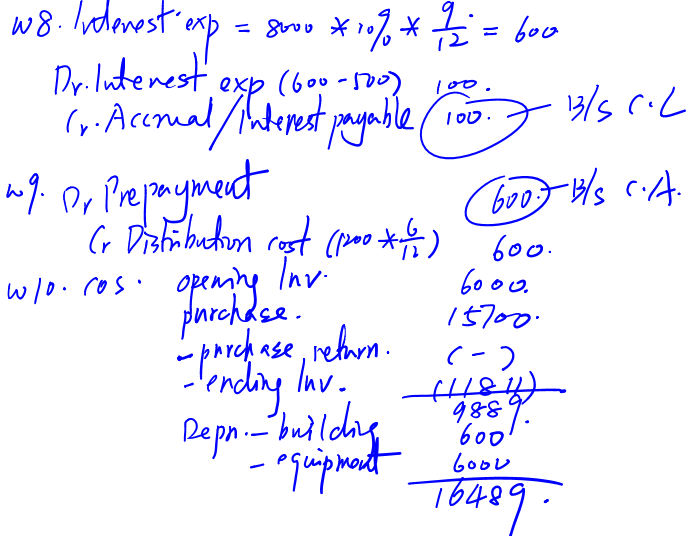

(8) 10% Loan note was made at 1st April 2020.

(9) Included within distribution costs is $1,200 relating to an advertising campaign that will run from 1 July 2020 to 30 June 2021.

Required:

(a)Prepare the statement of profit or loss for Petty for the year ended 31 December 2020

(b) Prepare statement of changes in equity for 2020

(c) Prepare the statement of financial position as at 31 December 2020.

Answer:

|

Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2020 |

|

|

Sales |

55,000 |

|

Sales return |

(200) |

|

Net sales |

54,800 |

|

COS |

(16,489) |

|

Gross profit |

38,311 |

|

Distribution cost (8,000-600) |

(7,400) |

|

Administration expense (14,850+1,400+300-120+1,000) |

(17,430) |

|

Operating profit (PBIT) |

13,481 |

|

Operating profit (PBIT) |

13,481 |

|

Finance cost |

(600) |

|

Profit before tax (PBT) |

12,881 |

|

Income tax |

(2,500) |

|

Profit for the year |

10,381 |

|

Other comprehensive income |

|

|

Gain on revaluation |

4,000 |

|

Total comprehensive income |

14,381 |

|

Statement of Changes in Equity for the year ended 31 December 2020 |

||||||

|

Share capital |

Share premium |

Pref. share |

R.E. |

R.S. |

Total |

|

|

Bal. @1 Jan. 2020 |

8,000 |

3,000 |

9,000 |

1,800 |

0 |

21,800 |

|

T.C.I. |

- |

- |

- |

10,381 |

4,000 |

14,381 |

|

Issue of shares |

2,000 |

1,000 |

- |

- |

- |

3,000 |

|

Pref. dividend |

- |

- |

- |

(900) |

(900) |

|

|

Intrim dividend |

- |

- |

- |

(1,600) |

- |

(1,600) |

|

Bal. @ 31 Dec. 2020 |

10,000 |

4,000 |

9,000 |

9,681 |

4,000 |

36,681 |

|

Statement of Financial Position as at 31 December 2020 |

|

|

Asset |

|

|

Non-current Asset |

|

|

Land and building |

14,000 |

|

Plant and equipment |

24,000 |

|

Total non-current asset |

38,000 |

|

Current Asset |

|

|

Cash |

9,950 |

|

T.R. (9,500 – 1,080) |

8,420 |

|

Inventory |

11,811 |

|

Prepayment |

600 |

|

Total Asset |

68,781 |

|

Equity and Liabilities |

|

|

Equity |

|

|

Share capital |

10,000 |

|

Share premium |

4,000 |

|

Preference shares |

9,000 |

|

Retained earning |

9,681 |

|

Revaluation surplus |

4,000 |

|

Total equity |

36,681 |

|

Liabilities |

|

|

Non-current liability |

|

|

10% Loan note |

8,000 |

|

Current liability |

|

|

Trade and other payable |

20,000 |

|

Current tax |

3,000 |

|

Interest payable |

100 |

|

Provision |

1,000 |

|

Total liabilities |

32,100 |

|

Total equity and liabilities |

68,781 |

王老师

2022-01-26 12:17:44 875人浏览

Total Comprehensive Income-综合收益总额

每个努力学习的小天使都会有收获的,加油!相关答疑

-

2024-10-27

-

2024-01-09

-

2022-03-21

-

2022-03-21

-

2022-03-21

津公网安备12010202000755号

津公网安备12010202000755号