T账数据如何分析?

记成这种T账形式的都是所以表吗,如何判断一个项目或者一笔款项记在T账的哪边,如何判断它是借记还是贷记的呢,还有每个项目的名称是事先给出的,还是自己想的

问题来源:

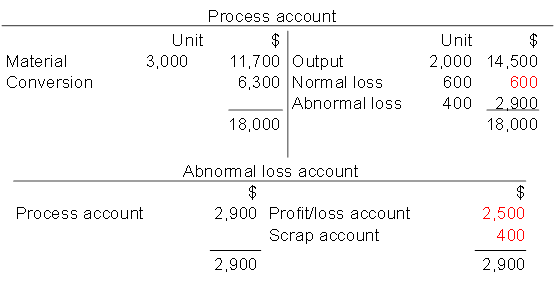

3. Losses with scrap value

Scrap is “Discarded material having some value”.

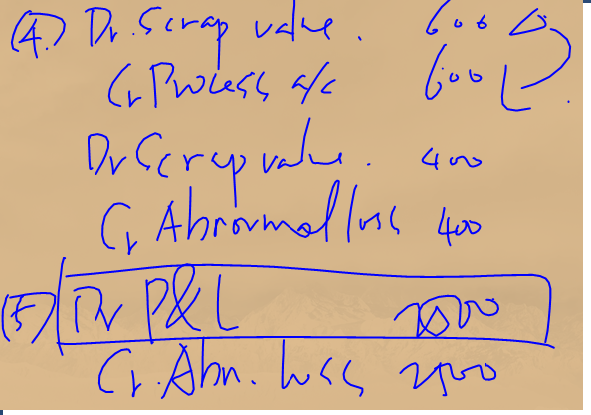

The scrap value of normal loss is usually deducted from the cost of materials.

The scrap value of abnormal loss (or abnormal gain) is usually set off against its cost, in an abnormal loss (abnormal gain) account.

Example: 3,000 units of material are input to a process. Process costs are as follows:

Material: $11,700

Conversion costs: $6,300

Output is 2,000 units. Normal loss is 20% of input.

The units of loss could be sold for $1 each.

Required: prepare a process account and the appropriate abnormal loss/gain account.

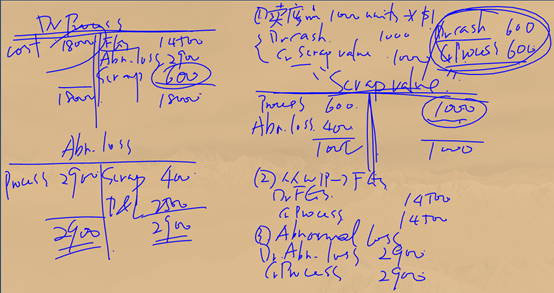

Solution:

Step 1: determine output and losses

|

|

|

units |

|

Actual Loss |

3,000 units-2000units |

1,000 |

|

Normal Loss |

3,000units × 20% |

600 |

|

Abnormal loss |

|

400 |

Step2: calculate cost per unit of output and losses

|

Costs incurred |

= |

($11,700 - $600)+$6,300 |

= |

$7.25 per unit |

|

Expected output |

3,000 units × 80% |

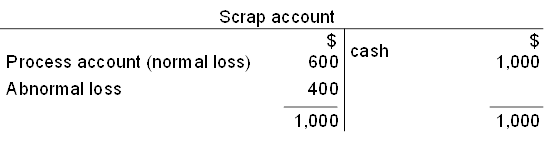

Scrap value of normal loss = 600*$1 = $600

Scrap value of abnormal loss = 400*$1 = $400

Step3: calculate total cost of output and losses

|

|

$ |

|

|

Cost of output |

2,000 units × $7.25 |

14,500 |

|

Normal loss |

600 units ×$1 |

600 |

|

Abnormal loss |

400 units × $7.25 |

2,900 |

|

Total cost |

|

18,000 |

Step4: complete accounts(1)

Step4: complete accounts(2)

相关答疑

-

2023-11-20

-

2023-11-20

-

2023-11-20

-

2021-10-31

-

2021-10-31

津公网安备12010202000755号

津公网安备12010202000755号