问题来源:

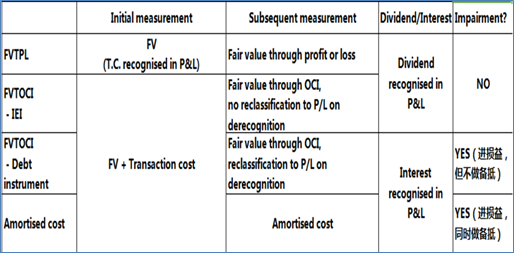

4.2 Measurement

4.2.1 For investments in debt that are measured at amortised cost (债权投资):

• The asset is initially recognised at fair value plus transaction costs

• subsequently measured at amortised cost and interest income is calculated using the effective rate of interest

4.2.2 For investments in debt that are measured at fair value through OCI (其它债权投资)

• The asset is initially recognised at fair value plus transaction costs

• Interest income is calculated using the effective rate of interest

• At the reporting date, the asset will be revalued to fair value with the gain or loss recogised in other comprehensive income. This will be to profit or loss when the asset is disposed

4.2.3 Equity instruments that are measured at fair value through other comprehensive income(其它权益工具投资)

• The asset is initially recognised at fair value plus transaction costs

• At the reporting date, the asset will be revalued to fair value with the gain or loss recognised in OCI (no reclassification to P&L on derecognition. Dividend recognised in P&L.

4.2.4 For investments measured at fair value through profit or loss (交易性金融资产)

• The asset is initially recognised at fair value, with any transaction costs expensed to the statement of profit or loss.

• At the reporting date, the asset will be revalued to fair value with the gain or loss recognised in the statement of profit or loss.

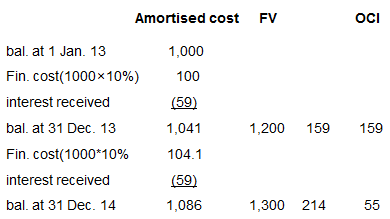

2. On 1 January 2013 Brown Co purchases a debt instrument for its fair value of $1,000. The debt instrument is due to mature on 31 December2017. The instrument has a principal amount of $1,250 and the instrument carries fixed interest at 4.72% that is paid annually. The effective rate of interest is 10%. Brown will hold the assets to collect the contractual cash flows, and when an opportunity arises, Brown will sell it.

The fair value of the instrument is $1,200 at 31 Dec. 2013 and $1,300 at 31 Dec. 2014.

The debt instrument is disposed at 25 Jan. 2015 and a proceed of $1,320 was received.

4.3 Reclassification of financial asset

Financial assets are reclassified when, and only when, an entity changes its business model for managing financial assets. The reclassification should be applied prospectively from the reclassification date.

These rules only apply to investments in debt instruments as investments in equity instruments are always held at fair value and any election to measure them at fair value through other comprehensive income is an irrevocable one.

王老师

2021-08-18 15:20:29 1441人浏览

哈喽!努力学习的小天使:

发放股利公司(现金股利)

declare:

Dr R.E (B/S)

Cr Dividend payable

paid:

Dr Dividend payable

Cr cash (B/S)

收股利的公司(现金股利)

declare:

Dr Dividends receivable

Cr invest income

paid:

Dr cash

Cr Dividends receivable

每个努力学习的小天使都会有收获的,加油!

相关答疑

-

2024-10-27

-

2022-08-30

-

2022-07-10

-

2022-07-05

-

2021-04-21

津公网安备12010202000755号

津公网安备12010202000755号